Newsletter - March 2024

An update for active members of the Local Government Pension Scheme

An update for active members of the Local Government Pension Scheme

We are pleased to provide our latest active member newsletter. This will help you keep up to date with the East Sussex Pension Fund. All articles can be viewed via this website page.

We are always looking for ways to develop and engage with our members so, please contact us with any ideas or further support you require.

Email: [email protected]

Kind regards

![]()

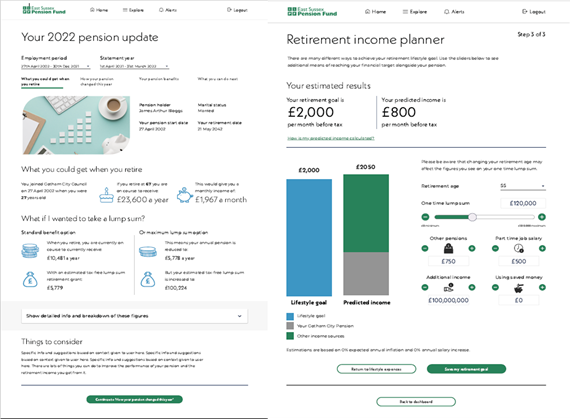

‘My Pension’ provides access to your Local Government Pension Scheme account(s) online.

We have been working with our software provider on improvements. As a result we will provide access to a new, modernised website later this year.

The new and improved site will make it far easier for you to keep up to date with your pension.

What’s new in ‘My Pension’?

‘My Pension’ will retain many of the existing features. Including the ability to update personal details, nominations and more.

Moving online saves money on stationery and postage and also helps reduce our carbon footprint, so we are all doing our bit to fight climate change.

Please keep an eye out for future communications regarding this exciting upgrade.

Our website has a host of useful information for members:

Homepage: Homepage | East Sussex Pension Fund

Paying-in page: Paying in | East Sussex Pension Fund

The ‘paying-in’ page offers a gateway to a range of information for active members of the Fund.

Forms and publications: Forms and Publications | East Sussex Pension Fund

We also have some handy guides available:

Brief guide to the LGPS – access here

Retirement Planning Guide – access here

Additional voluntary contributions and the LGPS – access here

There is also a national LGPS member website - www.lgpsmember.org

From April 2024 member contribution salary thresholds and rates are changing. See table below for salary bandings and contribution levels that will apply.

|

Band |

Actual pensionable pay for an employment |

Main section contribution rate |

50/50 section contribution rate |

|

1 |

Up to £17,600 |

5.50% |

2.75% |

|

2 |

£17,601 to £27,600 |

5.80% |

2.90% |

|

3 |

£27,601 to £44,900 |

6.50% |

3.25% |

|

4 |

£44,901 to £56,800 |

6.80% |

3.40% |

|

5 |

£56,801 to £79,700 |

8.50% |

4.25% |

|

6 |

£79,701 to £112,900 |

9.90% |

4.95% |

|

7 |

£112,901 to £133,100 |

10.50% |

5.25% |

|

8 |

£133,101 to £199,700 |

11.40% |

5.70% |

|

9 |

£199,701 or more |

12.50% |

6.25% |

Your contribution rate depends on your pensionable pay. It will be between 5.5% and 12.5% of this if you are in the main section of the LGPS. The rate paid depends on which pay band you fall into. If you work part-time or term time, your rate is based on the actual rate of pay for your job. So you only pay contributions on the pay you actually earn.

These changes could mean the % contribution you make could change if your pensionable pay at 1 April 2024 takes you into a different banding.

Most of us look forward to a happy and comfortable retirement. You may wish to consider paying extra pension contributions now to boost your income in later life. There are two ways you can pay extra contributions in the LGPS. You can pay Additional Pension Contributions, Additional Voluntary Contributions or both. You can also pay extra outside the LGPS to increase your retirement income.

Additional Pension Contributions

If you are in the Main Section of the LGPS you can pay extra contributions to purchase additional annual pension. These are known as Additional Pension Contributions (APCs).

You can pay APCs as regular monthly contributions over a number of complete years (minimum 12 month term) or you can pay a one-off lump sum either from your salary or paid directly to the Pension Fund.

The cost to purchase additional annual pension through APCs is determined by your age, term of payment and the amount you wish to purchase. You can find out the cost of buying additional annual pension by using an online APC calculator.

https://lgpsmember.org/more/apc/extra.php

Alternatively you can contact the pension team to request an individual APC quotation. Any amount of additional annual pension purchased, whether a pro rata amount or the full amount will be subject to a percentage reduction if payment of your pension benefits commences before your Normal Pension Age.

If you pay APCs through your Gross monthly salary and you are a tax payer you will receive tax relief at source. If you choose to make a lump sum payment directly to the Pension Fund, you will need to claim your tax relief directly through HMRC.

If you:

you will be credited with the amount of additional pension you have paid for.

Additional Voluntary Contributions

You can pay Additional Voluntary Contributions (AVCs) to top up your pension benefits. Our in-house AVC scheme is run by the Prudential.

You can pay a monthly contribution and choose how these contributions are invested. AVCs are deducted from your monthly salary. So, you will receive tax relief automatically on the contributions you pay (at your marginal rate). You can vary or cease payments at any time whilst you are contributing to the LGPS. Like APC’s you can pay in one-off lump sums but you would need to claim back tax relief yourself.

As AVCs are investment based, it is important to remember that the value can go down as well as up and you may not get back the amount you put in. You have to select the way the monies are invested and take the investment risk. The ESPF Pension Committee have created a default fund (With Profits) if you don’t want to actively select and manage your investments.

If you have an AVC fund with Prudential, you have a number of options available at retirement:

To find out more about AVCs and how to start contributions visit:

Local Government Pension with AVCs | Prudential (mandg.com) or contact the Prudential on 0345 600 0343

Deciding to take out an AVC plan is an important financial decision. We recommend you get guidance and/or independent financial advice. This will help you decide if this route is most suitable for you.

We recognise that the UK is going through a difficult time. This may result in some members being under financial stress. So, opting-out of your pension may seem a sensible, money-saving idea. But, doing so would be putting your longer term future security at risk. It's worth thinking about the benefits of the Local Government Pension Scheme before making any decisions.

As an alternative to opting-out completely the LGPS has a 50/50 option. This allows you to pay half your usual pension contributions without leaving the pension scheme. The downside of the 50/50 option is that you only build up half the usual pension while you are in it. However, if you were to die in service your death benefits would be unaffected. Any lump sum death grant and survivor pensions would be calculated as if you were a main section member. Read our cost-of-living article to find out more.

Cost of Living Crisis | East Sussex Pension Fund

One of the benefits of having an LGPS pension is that the value of your pension (and any payments) increase in line with inflation.

Your pension scheme is a Career Average Revalued Earnings (CARE) scheme. As an active member paying into the scheme, your pension is ‘revalued’ each year. This means the amount your pension is worth changes (or is revalued) based on inflation. This helps you keep up with the cost of living. For LGPS members, CARE revaluation only applies to benefits built up from 1 April 2014.

Your pension is revalued in line with the Consumer Price Index (CPI)*. This takes place on 6 April every year. From 6 April 2024 the benefits you have built up will be increased 6.7%.

*CPI is the official measure of inflation based on hundreds of different goods and services, the prices of which are tracked throughout the year.

The Normal Minimum Pension Age is changing. The Government has announced the earliest age that you can take your pension will increase from age 55 to 57 from 6 April 2028. This change will not affect ill health retirements. We will keep you informed as we receive more guidance around this change.

If you choose to take your pension benefits before your Normal Pension Age, they will normally be reduced. The reduction is based on the period between the date your benefits are paid and your Normal Pension Age. The earlier you take your pension, the bigger the reduction.

The current reductions for taking your benefits up to 13 years early are shown in the table below. These factors are regularly reviewed and can change from time to time. If the number of years is not exact, the reductions will be pro-rated.

|

Number of years paid early |

Pension reduction |

Lump sum reduction (for membership to 31 March 2008) |

|

0 |

0% |

0% |

|

1 |

4.9% |

1.7% |

|

2 |

9.3% |

3.3% |

|

3 |

13.5% |

4.9% |

|

4 |

17.4% |

6.5% |

|

5 |

20.9% |

8.1% |

|

6 |

24.3% |

9.6% |

|

7 |

27.4% |

11.1% |

|

8 |

30.3% |

12.6% |

|

9 |

33.0% |

14.1% |

|

10 |

35.6% |

15.5% |

|

11 |

39.5% |

n/a |

|

12 |

41.8% |

n/a |

|

13 |

43.9% |

n/a |

An example…

Stan’s normal pension age is age 65. He has £4,000 available as a pension. The example below shows the impact of Stan retiring early.

To get the most from your retirement, it is worth thinking about the lifestyle you want with the pension income you will get. Whether that's covering your basic needs or enjoying some luxuries along the way. To kick things off, it is good to have a target in mind and consider what lifestyle you can lead with that level of income.

The Pension and Lifetime Savings Association (PLSA) have recently revised their ‘Retirement Living Standards’ which predicts the amount of income you could need in retirement depending on the type of lifestyle you crave – whether that is a minimum, moderate or luxury lifestyle. The standards have been developed to help us to picture what kind of lifestyle we could have in retirement.

To find out more visit: https://www.retirementlivingstandards.org.uk/

Do not forget that we have a guide available on planning for retirement:

We have recently published our 2022/23 Annual Report and Accounts. Here are some key highlights…

|

Pension Fund Account Summary |

2021/22 £M |

2022/23 £M |

|

Opening Net Assets |

4,244.0 |

4,687.7 |

|

Contributions/other income (Payments from employers, employees and transfers from other pension funds) |

+142.4 |

+157.0 |

|

Benefits and other payments (Pension payments, leaver payments and lump sums) |

- 145.3 |

-146.7 |

|

Management Expenses |

- 26.7 |

- 30.8 |

|

Investment returns (Investments income and change in market value) |

+ 473.2 |

- 88.7 |

|

New increase during the year |

+ 443.6 |

-109.2 |

|

Closing Net Assets |

4,687.7 |

4,578.5 |

Full report and accounts:

Annual Report and Accounts 2022 23 - East Sussex Pension Fund

Pension scams are on the rise in the UK. The people behind the scams have become more sophisticated and are good at tricking you into handing over your money.

It is important that you have an idea of how to spot a pension scam, even if you think it could never happen to you.

Some warning signs of a pension scam could be:

You can help to protect yourself by learning how to spot a scam.

There is more information on the MoneyHelper website:

How to spot a pension scam | MoneyHelper

With an LGPS pension, you have the added reassurance of knowing that your loved ones will be looked after when you are gone. If you die before taking your pension, it provides a tax-free lump sum to family, friends or charities.

You can express a wish as to whom you would like to receive this lump sum (also known as your death grant), by nominating a beneficiary. The easiest way to do this is via our Member Self-Service Portal.

Your pension scheme has absolute discretion over who your death grant goes to. This is so it does not form part of your estate for tax purposes. They will however take your wishes/nomination into account.

Nominate your beneficiary today by visiting ‘My Pension’ (our member self-service portal)

Log in – Member Self-Service Portal

Register - Member Self-Service Portal

Alternatively you can complete the form below:

LGPS DG1 - Death grant expression of wish form (eastsussexpensionfund.org)

Before 6 April 2023, when you retired, you were required to pay an additional tax charge (known as the lifetime allowance tax charge) where your total pension built up went over a specific limit, currently £1,073,100. Most people could save as much as they wished with full tax relief because their pension savings were less than the allowance. The allowance covered all pensions in all tax-registered pension arrangements not just the LGPS. But it did not include the state retirement pension, state pension credit or dependants’ pensions like a widow’s or widower’s pension.

With effect from 6 April 2023, and in certain circumstances, pension funds continued to quote the proportion of the LTA members had used. However, where pension scheme members had exceeded the LTA, they were no longer liable for a tax charge.

On 6 April 2024, the lifetime allowance will be abolished completely. The Government have recently issued a new policy paper detailing what this means.

As a result of these changes, other new allowances will come into effect at the same time.

Amounts above these allowances will be taxed at the member or beneficiary’s marginal income tax rate.

*Some members have been able to apply for protection against the LTA in the past, meaning they can build up higher benefits without a tax charge. Those members with LTA protection will be able to take a different level of tax-free cash based on the amount of their protection. For example, for a member with a protected LTA of £1.5m, their tax-free cash available will be £375,000 (£1.5m x 25%).

Unfortunately, as is often the case with legislative change in Pensions things are never as simple as they seem. In addition to the changes highlighted above a new Transitional Allowance will take account of any LTA used prior to 6 April 2024 and reduce the LSA by 25% of that amount. An Overseas Transfer Allowance of £1,073,100 will also be introduced.

After reforming public service pension schemes in 2014 and 2015, the Government introduced transitional protections for older members. However, in December 2018, the Court of Appeal ruled that younger members of the judicial and firefighters’ pension schemes had been unlawfully discriminated against because the protections did not apply to them.

This ruling is called the ‘McCloud judgment’. As a result of the ruling, changes have been made to the LGPS to remove the age discrimination. These changes are known as the ‘McCloud remedy’.

The McCloud remedy only affects members who were:

We expect a very small number of people to be affected. We will ensure members receive the benefits they are entitled to.

We are here to help you. If you'd like to get in touch by email or phone, please visit our contact us page on the website.

If you are looking for free guidance on Pensions please visit the MoneyHelper website.

MoneyHelper joins up money and pensions guidance to make it quicker and easier to find the right help, MoneyHelper brings together the support and services of three government-backed financial guidance providers: the Money Advice Service, the Pensions Advisory Service and Pension Wise.